2021 PROXY SEASON ESG LOOKBACK

KEY TAKEAWAYS FOR RETAIL

- 11/26/2021

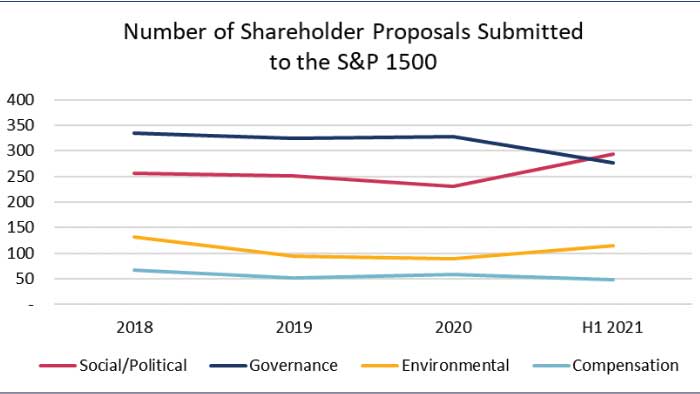

As the ESG landscape continues to rapidly evolve, an area for retailers to watch to make sense through all the noise is examining trends in proxy proposals. At Sullivan & Cromwell, we summarized a few key takeaways from the 2021 proxy season for the retail industry based on our review of Rule 14a-8 shareholder proposals submitted to U.S. members of the S&P Composite 1500 (the S&P 1500) for annual meetings held on or before June 30, 2021, and our in-depth analysis of shareholder proposals submitted to a sample of 11 retail companies (the Retail Companies). [1]

1) Environmental and social/political (ESP) proposals represented a majority of proposals submitted.

At the S&P 1500, submissions on ESP topics continued to increase and represented the majority of proposals submitted for the first time, comprising 56% of all submissions in the first half of 2021. Proposals on ESP topics represented an even greater proportion of proposals submitted at the Retail Companies, constituting 80% of all submissions to the Retail Companies.

2) Social capital management was the largest subcategory of social/political proposals at the S&P 1500 and the Retail Companies.

The number of social capital management proposals at the S&P 1500 increased by 43% in H1 2021 compared to full-year 2020, driven by the emergence of new categories of civil rights, human rights and racial justice proposals. While for the S&P 1500, most of the submitted social/political proposals related to EEO-1 reporting and political spending/lobbying, racial equity audit proposals and requests for human rights due diligence procedures were submitted in meaningful numbers at the S&P 1500 for the first time this year. Social capital management was particularly salient during the 2021 proxy season at the Retail Companies, where more submitted proposals related to civil rights, human rights and racial justice issues than to EEO-1 reporting and political spending/lobbying combined.

3) Environmental proposals trended upwards at the S&P 1500 and are expected to become more prominent in the upcoming proxy season.

While most submissions on environmental topics to both the S&P 1500 and the Retail Companies were withdrawn, major proponents rarely settled with companies unless the company committed to take actions towards the specified environmental goals or at least adopted their disclosure-based demand. Looking ahead, environmental proposals may be less likely to be excluded through the SEC no-action process. In a recent Staff Legal Bulletin, the SEC Division of Corporation Finance stated that going forward the staff would not concur in the exclusion of proposals that request companies to adopt timeframes or targets to address climate change on micromanagement grounds, so long as the proposals afford discretion to management as to how to achieve such goals.

[1] The Retail Companies include Walmart Inc., The Home Depot, Inc., Costco Wholesale Corporation, Lowe’s Companies, Inc., Target Corporation, The TJX Companies, Inc., The Kroger Co., Best Buy Co., Inc., Dollar Tree, Inc., Amazon.com, Inc. and eBay Inc. We also checked but did not find any publicly disclosed shareholder proposals for Wayfair Inc., Chewy, Inc. and Etsy, Inc.

Melissa Sawyer

Sullivan & Cromwell LLP

sawyerm@sullcrom.com

+1 212 558 4243

sullcrom.com

RILA members interested in learning more can login to view the slides and recording from the November 9th RILA 2021 Proxy Season ESG Lookback: Key Takeaways for Retail webinar featuring Melissa Sawyer of Sullivan & Cromwell LLP here.

For more information about the retail industry’s approach to ESG and RILA’s executive communities exploring these topics, please reach out to RILA Vice President of CSR Erin Hiatt.