Investing in Innovation for a New Era of Retail

- By [ Zhenni Liu ]

- 05/20/2020

The shelter-in-place policies enacted to contain the spread of COVID-19 have forced total closure of physical retail and led to a sudden, severe shift in consumer behavior. As consumers have pulled back on discretionary spending and focused on essential items, shopping has shifted towards digital channels and retailers are scrambling to respond. In this environment, there is an immediate, urgent need to manage short-term cash shortfall and operational risk. However, looking ahead, retailers need to accelerate innovation efforts to maintain (and perhaps even gain market share).

Retail response to COVID

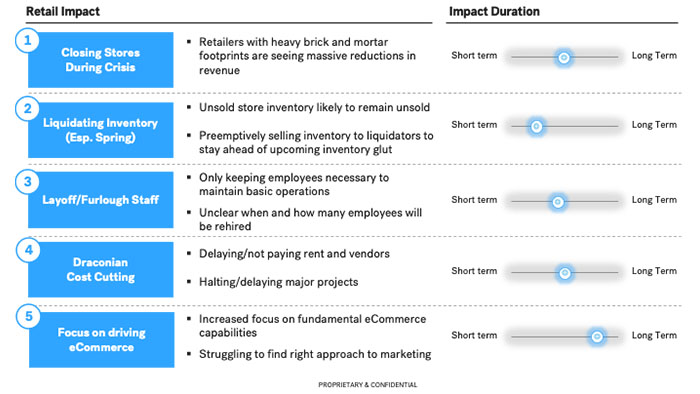

COVID presents a defining moment for retail that may forever change the industry. Brands and retailers that lack sufficient liquidity and fail to adapt quickly enough will face potential collapse in the next couple of months. Those with the capital, capabilities and experience to double down on eCommerce will thrive. In the past month, retailers have already made dramatic changes to their business. The figure below shows five areas of impact. Some of these efforts are to address the current reality (e.g., store closure) whereas others are important for cash management and long term positioning (e.g., focus towards eCommerce).

Capabilities to invest to survive and thrive in COVID

During COVID, there’s been a dramatic shift to digital channels. Retailers that don’t successfully transition their offline customers to their online offerings risk losing those customers even after stores re-open. Our conversations with portfolio CEOs and industry executives highlight a number of areas that retailers can focus on to manage short term risk and take advantage of long term trends:- Delivery infrastructure: Retailers who have delivery from store or BOPUS infrastructure have an immediate advantage during the current crisis. In the short term, retailers and brands can fulfill orders, but in the long term, this can drive increased conversion and customer loyalty.

- New shopping experiences (e.g., AR showrooms): Emerging social and digital shopping channels have been particularly popular in other countries (e.g., China). Retailers can leverage these platforms to address the void left by store closures. If done correctly, this can be a new distribution channel.

- Remote workflow/collaboration: Work-from-home orders and travel bans are creating momentum for virtual tools for collaboration. Organizations have already quickly pivoted operations to enable continuity of business. This includes introducing new communication channels (e.g., Zoom) as well as new collaboration platforms tailored for workflow (e.g., product development platforms). In the long term, this overall shift may drive increased organizational productivity.

- eCommerce capabilities: More than ever, now is the time to be doubling down on core eCommerce infrastructure. The shift towards digital has only accelerated with COVID. Retailers and brands with budgets to invest in digital marketing will benefit from this season.

- New in-store technology: Adjusting store ops to ensure social distancing and minimization of virus spread will be critical once doors are opened again. This includes store technology such as cashier-less check out to limit in-person contact and traffic counting/gating analytics to monitor capacity and social distancing. While some of these may require more upfront investment, in the long term, it can improve customer experience, reduce staffing needs, and improving overall OPEX.

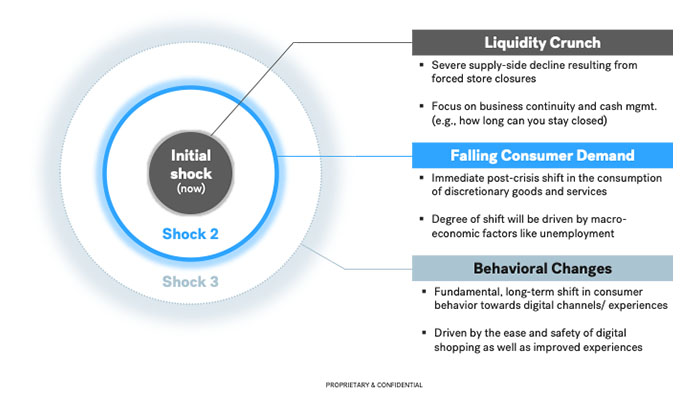

Three Waves of Impact from COVID crisis on Retail

Ultimately we believe the COVID crisis will impact retailers and brands over three different waves as depicted in the figure below.

Conclusion

In conclusion, retailers that don't successfully transition and adapt to the new normal are at risk of losing customers long term. The challenge ahead is investing and prioritizing in the right areas of innovation for this new era of retail.Tags

-

Technology & Innovation

-

Retail Innovation Center