- Home

- Retail Insights

- Retail Speaks: Seven imperatives for the...

The retail industry has seen more innovation in the past year than at no other point in the prior decade. When faced with lockdowns, an array of new health-and-safety regulations, and volatile consumer demand, the best retailers proved resilient and agile. So, what has set the top performers apart? And how can retailers thrive in 2021 and beyond, even amid continuing uncertainty? The answers aren’t trivial: as the nation’s largest private-sector employer, the retail industry affects the lives and livelihoods of millions.

In this report, we present research findings from the Retail Industry Leaders Association (RILA), with McKinsey & Company as a knowledge partner. Our analysis identified seven imperatives that can give retailers the ability to adapt to a changing consumer landscape while pursuing new opportunities.

For a free copy of the report, please complete the form below.

7 IMPERATIVES FOR RETHINKING RETAIL

The changing competitive landscape will require retailers to pursue seven imperatives. The first four will be familiar to retailers, so their challenge will be to accelerate progress. The next three imperatives represent additional strategies and efforts that will be increasingly critical in the coming years

The ideal recipe will vary by retailer, so executives should review these imperatives based on their organization’s starting point, business strategy, and the approach that fits best with their brand’s DNA.

Doubling down on consumer-driven commerce

1 — BECOME OMNIPOTENT ON OMNICHANNEL

Consumers will choose retailers based on ease and richness of end-to-end experience

2 — THIS TIME (AND ALL THE TIME), IT'S PERSONAL

Consumers expect personalized experiences and offers as table stakes; most retailers fall short of these expectations today

To successfully implement omnichannel personalization, retailers will need to coordinate corporate efforts with store teams, integrate cross-channel activities, incorporate personalization into the in-store experience, and make more data-driven decisions. The end goal is to use sophisticated, largely digital capabilities to create distinctive customer experiences.

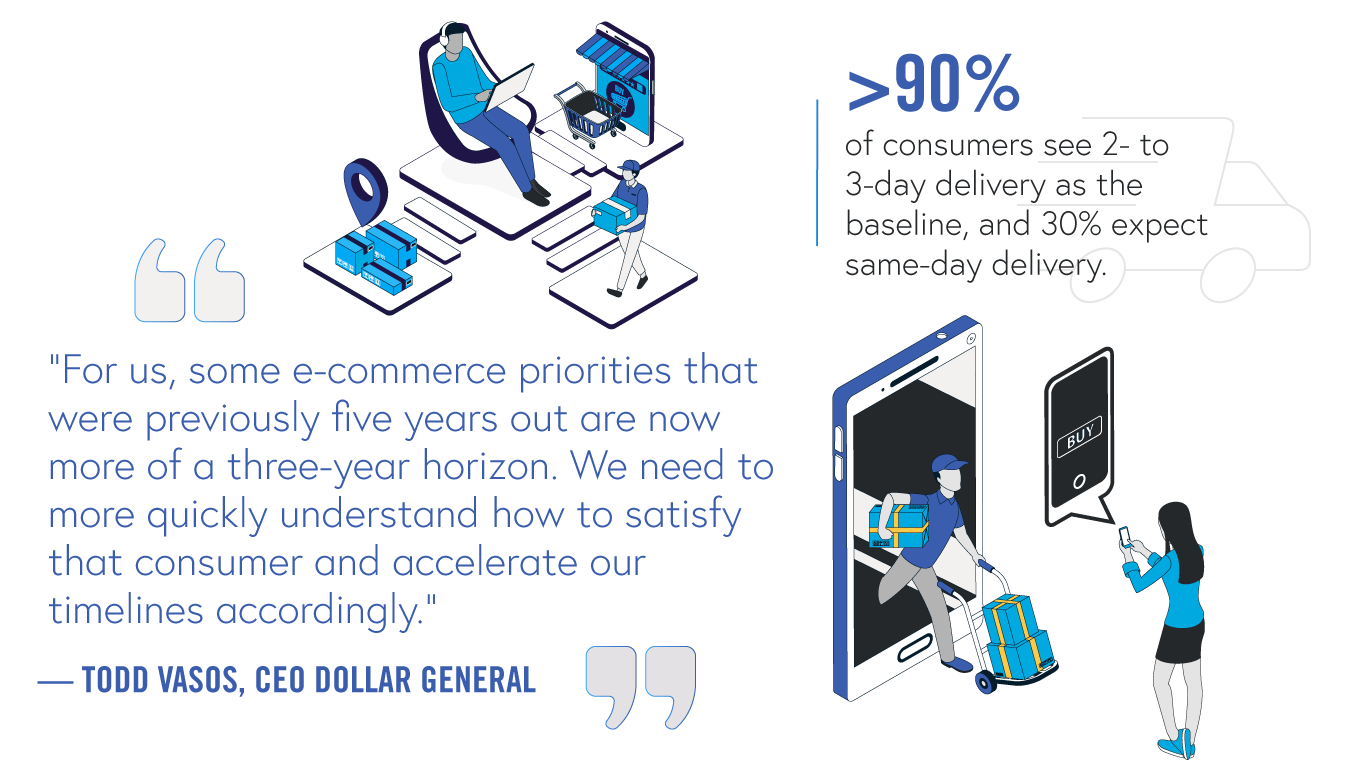

3 — TURBOCHARGE DELIVERY

As consumer expectations approach same day, stress on supply chain will mount

In response, retailers are setting ambitious targets that will require significant investments to propel their supply chain fulfillment capabilities. Our survey found that 80 percent of retailers plan to concentrate their 2022 supply chain spending on addressing the constant demands on e-commerce fulfillment.

4 — TAKE A STAND OR TAKE A SEAT

Consumers are finally voting with their wallets for sustainability and broader purpose

Most retailers understand the link between “doing good” and bottom-line impact. Most (80 percent) believe that company actions matter to consumers, and 64 percent believe that those actions affect purchase decisions.

Investing for growth

5 — RECALIBRATE TALENT STRATEGIES

Winning the war for diverse talent, next-gen skills, and embracing a fluid workplace will give retailers a performance advantage

In addition, retailers can significantly expand their talent pool for hourly and frontline associates by tapping into on-demand labor models such as the gig economy. Last, diversity and inclusion looms especially large, and leading retailers are making commitments to increase diversity in their workforce and the products they sell.

6 — PURSUE AN ECO(SYSTEM) - FRIENDLY STRATEGY

Winners will embrace the networked economy to win consumer mindshare and accelerate capabilities

7 — TAKE PRODUCTIVITY FROM FOUNDATIONAL TO TRANSFORMATIONAL

Analytics and automation will enable the step change in productivity needed to fund the other imperatives

Our research uncovered five areas that hold particular promise: tech-enabled stores, automated supply chains to increase visibility, indirect spending optimization, private-brand innovation and sourcing excellence, and automated business support functions.

About the research

The Retail Industry Leaders Association (RILA), with McKinsey & Company as a knowledge partner, conducted research on how retailers are approaching strategy and operations. Executives (such as CFOs, chief marketing officers, chief digital officers, and chief supply chain officers) at more than 30 US companies completed a benchmarking survey that covered more than 100 metrics and explored consumer outlook, digital acceleration, and future supply chain. The survey was augmented by in-depth interviews with top retail CEOs as well as proprietary McKinsey & Company customer research. The analyses and discussions identified the imperatives that will be critical to retail success now and in the future.

We wish to thank the following for their contributions to this report

Industry Insights

Retailers Urge Bipartisan Solutions Ahead of State of the Union

- By [Austen Jensen]

- 02/24/2026

Retailers Urge Congress, White House on Trade Stability

- 02/20/2026

U.S. Maritime Revitalization: What Retailers Should Know

- By [Sarah Gilmore]

- 02/19/2026

What LINK2026 Revealed About the Future of Retail Supply Chains

- By [Jess Dankert]

- 02/11/2026

In Defense of Digital Price Tags

- 02/10/2026

RILA Board of Directors Welcomes Five New Members and Names Phil Daniele as Board Chair

- By [Brian Dodge]

- 01/26/2026