2022 Proxy Season Look Ahead

Key Considerations for Retail Companies

- 02/24/2022

As public retail companies or “issuers” address Rule 14a-8 shareholder proposals and otherwise prepare for upcoming annual shareholder meetings, it is helpful to consider related ESG trends, institutional investors’ and proxy advisors’ voting policies, and changes in SEC regulations. To help inform RILA member preparations, Sullivan & Cromwell summarized selected considerations below, with retail-specific data points.

1) Environmental proposals continue to gain traction as institutional investors, proxy advisors and the SEC support enhanced climate-related disclosures.

In the first half of 2021, we saw the number of proposals on environmental topics submitted to S&P 1500 companies increase by 40% over the first half of 2020. While only 29% of the environmental proposals that were submitted went to a vote, the voted proposals garnered greater shareholder support on average (41%) than proposals on other topics.Data from the past few months suggest that, while environmental proposals continue to make up a relatively small proportion of all voted proposals, many of the voted proposals are being passed. Recently passed proposals include a climate transition plan proposal submitted by As You Sow to AutoZone and a proposal to adopt greenhouse gas emissions reduction targets submitted by Green Century to Costco, each of which passed by a 70% shareholder vote despite the companies’ boards recommending against the respective proposals.

These results are generally consistent with the largest institutional investors’ (BlackRock, State Street, Vanguard) and proxy advisors’ support for enhanced climate-related disclosures. The SEC is also working on a new rule to mandate climate-related disclosures, with a proposed rule expected by the end of Q1 or in Q2.

2) Proposals seeking DEI and HCM disclosures may get more shareholder support.

Building on the rise of social/political shareholder proposals over the last couple of years, a number of proposals seeking independent audits of racial equity, civils rights and/or DEI policies and practices as well as proposals requesting quantitative reporting on DEI efforts have been submitted for shareholder meetings in 2022. The New York State Comptroller, The National Center for Public Policy Research and As You Sow, among other proponents, have submitted these types of proposals to various retail companies.BlackRock, State Street and Vanguard generally support calls for enhanced DEI-related disclosure, though their specific policies may differ from each other and diverge from the shareholder proposals that are being submitted. Moreover, BlackRock’s announced policy change to enable some of its clients to direct how proxies are voted may have uncertain impacts on voting outcomes generally. Investor preferences will also need to be reconciled with additional SEC rulemaking expected later in 2022 to enhance issuer disclosure on human capital management.

3) Recent SEC staff guidance has narrowed the “ordinary business” and “economic relevance” bases for excluding Rule 14a-8 shareholder proposals.

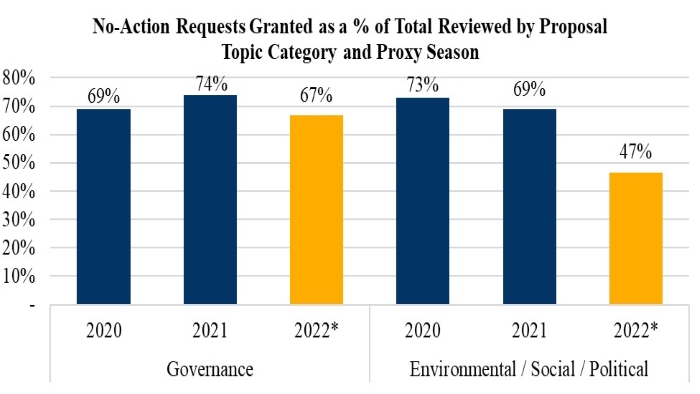

On November 3, 2021, the SEC issued new guidance rescinding its prior guidance and announcing a shift from the SEC analyzing the significance of the issues to specific companies to a new a focus on evaluating whether proposals raise issues with a broad societal impact. Preliminary data on issuers’ requests for no-action relief submitted since September 1, 2021 suggest that fewer requests are being submitted, and the SEC is taking longer to respond to requests and granting fewer requests. In the wake of the recent staff guidance narrowing some of the substantive bases for excluding shareholder proposals, procedural bases appear to continue to be the most effective approach for issuers to exclude proposals.

sawyerm@sullcrom.com | +1 212 558 4243 | sullcrom.com

RILA members interested in learning more can login to view the slides and recording from the February 8th RILA 2022 Proxy Season Look Ahead: Key Considerations for Retail webinar featuring Melissa Sawyer of Sullivan & Cromwell LLP here.

For more information about the retail industry’s approach to ESG and RILA’s executive communities exploring these topics, please reach out to RILA Vice President of CSR Erin Hiatt or Executive Vice President and Deputy General Counsel Kathleen McGuigan.

The information contained in this blog post is general in nature and provided for educational purposes only. It may not reflect all recent developments and may not apply to specific facts and circumstances. It should not be construed as legal advice.

Tags

-

Climate and Sustainability

-

Ensuring a Safe, Sustainable Future

-

Legal Affairs & Compliance

-

Retail Sustainability

-

Sustainability & Environment