2022 Proxy Season ESG Lookback

Key Takeaways for Retail

- 11/21/2022

In 2022, proxy proposals submitted to U.S. public companies continued to reflect the significant investor focus on ESG issues, in particular on climate change and social and human capital management. Notably, this year, the proxy proposal trends also reflected the intensifying national debate around ESG. At Sullivan & Cromwell, we summarized a few key takeaways from the 2022 proxy season for the retail industry based on our review of Rule 14a-8 shareholder proposals submitted to retail companies[1] that are U.S. members of the S&P Composite 1500 (the S&P 1500) for annual meetings held on or before June 30, 2022.

1) Environmental and social/political (ESP) proposals represented a majority of proposals submitted.

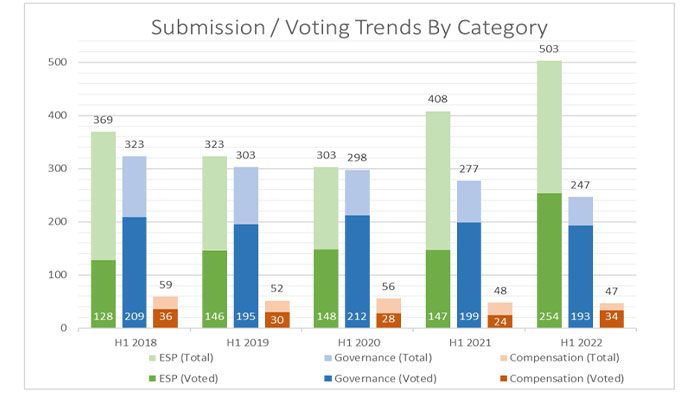

At the S&P 1500, submissions on ESP topics continued to increase, comprising 63% of all submissions in H1 2022. Proposals on ESP topics represented an even greater proportion of proposals submitted at retail companies, constituting 77% of submissions in H1 2022.

2) Recent SEC developments had a significant impact on 2022 ESP proposals, and we expect the SEC’s extensive ESG-related rulemaking to have an even greater impact on submission, voting and engagement trends in future proxy seasons.

The SEC issued new guidance under Staff Legal Bulletin No. 14L (SLB 14L), which significantly narrowed the standards for the “ordinary business” and “economic relevance” exclusions. Following the release of SLB 14L, companies had a drastically lower likelihood of obtaining no-action relief on ESP proposals, with success rates dropping from 79% to 48% on no-action requests from retail companies. As a result, substantially more shareholder proposals made it to a shareholder vote.

Historically, most ESP proposals—especially proposals on social/political topics—have been resolved without reaching a shareholder vote, either through private engagement between the proponent and the target company, or through the SEC no-action process. In 2022, however, a majority of ESP submissions reached a vote, with the percentage of voted social/political proposals increasing by a staggering 72%. The increase in voted proposals was slightly less pronounced in the retail sector, where 46% of ESP proposals—including the majority of social/political proposals—reached a vote.

3) Social and environmental proposals increased while governance proposals decreased.

Social/political proposals remained the largest category of submissions, increasing 17% overall and 37% in the retail sector. The main driver of this increase was an 81% growth in the number of submissions on civil rights, human rights and racial equity impact. In the retail industry, these proposals represented the most prevalent sub-topic (20%) of social/political submissions. Six social/political proposals in the retail sector received a majority of votes cast (compared to none in 2021), including three racial equity/civil rights audit proposals.

Environmental proposals increased by the greatest margin—38% overall and 48% in the retail sector, with 45% of these proposals in the retail sector focusing on greenhouse gas reduction and other climate-related targets.

In contrast, governance proposals further decreased (by 11% overall), especially in the retail sector (by 45%). A third of these proposals in the retail sector focused on amending special meeting thresholds and 20% focused on requiring an independent board chair.

4) Shareholders demanded alignment between companies’ stated ESG priorities and their political spending.

2022 also saw the first political proposals asking retail and other companies to assess alignment between their stated company values and ESG priorities and their records on political contributions and lobbying activities. In addition, companies also received a meaningful number of proposals on the alignment between their lobbying activities and the Paris Agreement goals. In the 2023 proxy season, we expect these proposals to increase in number and specificity.

5) There was a notable increase in the number of proposals—in particular social proposals—submitted by self-identified “anti-ESG” entities.

Identifiable “anti-ESG” proponents submitted 54 proposals for meetings in H1 2022 (compared to 25 in full-year 2021), with 22% of such proposals targeting retail companies. These included nine proposals on civil rights audits, and 14 proposals demanding a report on companies’ charitable contributions.Social proposals submitted by “anti-ESG” proponents received much lower average shareholder support than social proposals submitted by other proponents (9% and 29% of votes cast, respectively). Civil rights audit, charitable contribution and political congruency proposals submitted by “anti-ESG” proponents, for example, generally received lower than 10% of votes cast, notwithstanding the fact that they were facially similar to high-vote proposals on the same topics submitted by other proponents. These outcomes illustrate the significance of a proponent’s stated policy agenda on voting outcomes, which is an important development this season.

6) We expect more companies to receive severance-related proposals, which received high shareholder support in 2022.

This year, 13 companies in the S&P 1500 requested the board seek shareholder approval for large executive severance or termination payments,[2] suggesting that, even in a competitive market, shareholders remain wary of potentially excessive or unreasonable severance payments. These proposals received a decade-high average support of 30% and three passed. | Melissa Sawyer | June M. Hu |

| Sullivan & Cromwell LLP | Sullivan & Cromwell LLP |

| sawyerm@sullcrom.com | huju@sullcrom.com |

| +1 212 558 4243 | +1 212 558 4356 |

RILA members interested in learning more can login to view the slides and recording from the October 27th RILA 2022 Proxy Season ESG Lookback: Key Takeaways for Retail webinar featuring Marc Treviño and June Hu of Sullivan & Cromwell LLP here. View Sullivan & Cromwell’s overall 2022 Proxy Season Review here.

For more information about the retail industry’s approach to ESG and RILA’s executive communities exploring these topics, please reach out to RILA Vice President of CSR Erin Hiatt. For information on corporate governance and RILA’s legal and compliance communities, please reach out to Kathleen McGuigan, RILA EVP & Deputy GC.

Tags

-

Ensuring a Safe, Sustainable Future

-

Climate and Sustainability

-

Legal Affairs & Compliance

-

Public Policy