IRA and IIJA Funding Opportunities for Retail

- Home

- Focus Areas

- Sustainability / Environment

- IRA and IIJA Funding Opportunities for Retail

Last Updated: May 1, 2024

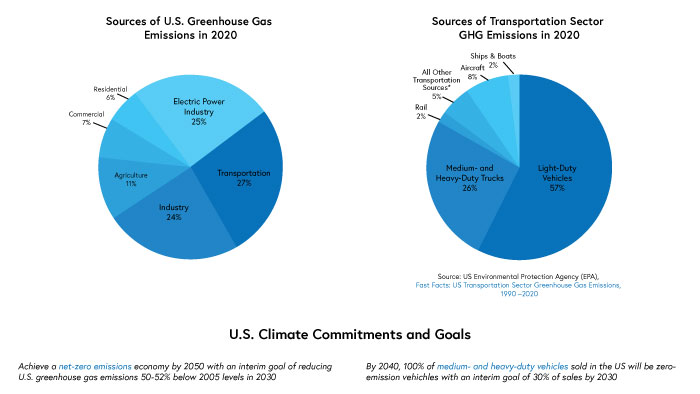

The bipartisan Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) authorize significant federal spending and tax saving opportunities to advance the nation’s infrastructure modernization and decarbonization goals, particularly in the transportation, building, and electric power sectors.

Retailers are in an advantageous position to both:

- Use the federal opportunities to increase their own operational efficiency and reduce upfront costs associated with meeting emissions reduction goals; and

- Engage with federal, state, and local governments to ensure the programs are effectively implemented and support infrastructure developments that accelerate retail industry decarbonization.

- Are there particular programs listed in this briefing for which your company would like more information?

- How else can RILA advocate on behalf of its members in conversations with federal and state officials with regard to these funding opportunities?

- What additional information would assist your company in better understanding what state funding is available for EV charging infrastructure to benefit retailers?

- Can RILA help facilitate conversations between your company and your landlord(s) or fleet partners to gauge their interest in these funding programs?

- Can RILA help facilitate conversations between your company, state retail associations, and the state or local entities that will be seeking funds for infrastructure projects in your area?

- Can RILA help facilitate conversations between your company and the federal agency administering the funding program?

- Are there other IIJA or IRA programs not listed here that can help advance your company’s decarbonization efforts and are of interest to your company (e.g., climate agriculture projects in IRA)?

You can also learn more about IRA programs in the IRA guidebook from the White House and through the Internal Revenue Service guidance documents.

Summary Table

|

|

Direct Federal Opportunities for Retailers (Part 1) |

Direct Federal Opportunities for Customers (Part 1) |

Direct Opportunities Administered by State & Local Governments for Retailers and Customers (Part 2) |

Opportunities for Retailers to Inform the Modernization of Transportation Networks (Part 3) |

|

Vehicle Emissions: Scopes 1 and 3

|

IRA Tax incentives for EV chargers at commercial properties (1.1.a) |

IRA Tax incentives for residential EV chargers (1.1.c) |

IIJA State funding to support the buildout of EV infrastructure (2.2.a-c) |

|

|

IRA Tax inventives for commercial electric fleets (1.1.b) |

IRA Tax incentives for passenger EV vehicles (1.1.d) |

|

|

|

|

IRA Tax incentives for alternative fuels (1.1.c) |

||||

|

Building-Related Emissions: Scopes 2 |

IRA Tax incentives to improve building efficiency (1.2.a) |

IRA Tax incentives for Energy Star products that increase energy efficiency (1.2.d) |

IIJA Revolving loan/grant program for commercial energy audits, upgrades, and retrofits (2.1.a) |

|

|

IIJA Rebates for transformers (1.2.b) |

|

|

|

|

|

IIJA Rebates for extended product systems (1.2.c) |

|

|

|

|

| Renewable Energy: Scope 2 | IRA Tax incentives for renewable energy (1.3.a) | |||

| IRA Tax incentives for advanced energy projects (1.3.b) | ||||

| IRA Tax incentives for carbon capture (1.3.c) | ||||

| IRA Tax incentives for clean hydrogen (1.3.d) | ||||

|

Emissions Reduction and Renewable Energy Projects |

|

IRA USDA Powering Affordable Clean Energy Program (2.3.a) |

IRA EPA Greenhouse Gas Reduction Fund (2.3.b) |

|

|

Freight Emissions: Scopes 1 and 3 |

|

|

|

IIJA National Highway Freight Program (3.1.a) |

|

|

|

|

IIJA Multimodal Project Discretionary Grants (Mega Grants, INFRA Grants & Rural Surface Transportation Grants) (3.1.b and c) |

|

|

Emissions at Ports: Scopes 1 and 3 |

|

|

|

IIJA EPA Port Program (3.2.a) |

|

|

|

|

IIJA Port Infrastructure Development Program (3.2.b) |

|

|

|

|

|

IIJA Reduction of Truck Emissions at Port Facilities (3.2.c) |

Key Terms:

Scope 1 covers the direct emissions from company owned or controlled sources. This category includes emissions related to company-owned real estate and from company-owned vehicles.

Scope 2 covers emissions from the generation of purchased electricity consumed by the reporting company. Energy efficiency measures can help reduce Scope 2 emissions.

Scope 3 includes all other indirect emissions that occur in a company’s value chain but are not under the direct control of the company. This category includes emissions from everything from purchased goods and services to employee travel to third-party transportation and distribution networks used to support a company’s operations. Learn more about emissions scopes and more in RILA’s Retail Climate Action Blueprint.

PART 1: DIRECT FEDERAL OPPORTUNITIES

1.1. Vehicles

1.1.a Is your company interested in installing Electric Vehicle (EV) chargers at commercial properties for your customers, employees, and/or fleet vehicles?

- Summary: Tax incentive for EV chargers at commercial properties. The IRA increases from $30,000 to $100,000 the maximum tax incentive to install electric vehicle chargers or alternative fueling at commercial properties, specifically in low-income and rural census tracts. The tax incentive will cover 6% of the cost of the equipment, with a max of $100,000 per unit.

- Timeline: After 2022, the equipment must be installed at locations that either are in a population census tract where the poverty rate is at least 20% or are a metropolitan and non-metropolitan area census tract where the median family income is less than 80% of the state medium family income level.

- Best for: Convenience stores, big box stores, and retailers with offices or distribution warehouses with locations in eligible census tracts. Retailers that are not interested in owning chargers themselves may want to explore partnering with charging companies to install and own the chargers on the retailers’ commercial property.

- Learn more: US DOE, Alternative Fuels Data Center | January 2024 IRS Form | Temporary waiver of certain Made in America requirements

1.1.b Does your company own any portion of its commercial fleets (any size vehicles) or contract with a third-party shipper?

- Summary: Tax incentives for commercial electric fleets. The IRA creates a new 30% tax incentive for organizations to purchase electric vehicles for commercial use. The credit will cover up to $7,500 for vehicles under 14,000 pounds and $40,000 for vehicles above 14,000 pounds. Unlike EV credits for personal vehicles which require the vehicles be built largely from materials sourced in the U.S, the commercial electric fleet credit does not have the battery or mineral sourcing requirements.

- Timeline: Available now. Applies to vehicles purchased before 2033.

- Best for: Retailers who own commercial vehicles and are interested in reducing their Scope 1 emissions. Retailers who contract to meet their transportation needs may want to consider encouraging their transportation partners to utilize this program as reductions in third-party emissions contribute to reductions in Scope 3 emissions.

- Learn more: IRS Tax Guidance | IRS Fact Sheet

1.1.c Does your company own any portion of its commercial fleets (any size vehicles) that use alternative fuels or contract with a third-party shipper that uses alternative fuels?

-

Summary: Tax incentives for alternative fuels. The IRA extends a set of tax incentives for the use or sale of alternative fuels, biodiesel and renewable diesel.

-

Timeline: Available through the end of 2024.

-

Best for: Retailers who own (or contract commercial) vehicles that use alternative fuels and are interested in reducing the costs of the lower-emission fuels

-

Learn more: Alternative Fuels Data Center

1.1.d Does your company sell EV charging equipment?

- Summary: Tax incentives for residential chargers and passenger vehicles. The IRA offers consumers who purchase qualified residential fueling equipment a tax credit of 30% of the cost of the charger (up to $1,000).

- Timeline: Available now. Charging equipment must be purchased between January 1, 2023, and December 31, 2032.

- Best for: Retailers who sell electric vehicles or electric vehicle equipment. While the consumers will need to apply for the tax incentive themselves, retailers can help market their products by increasing consumer awareness of the tax incentive.

- Learn more: US DOE, Alternative Fuels Data Center information on fueling infrastructure credit | Temporary waiver of certain Made in America requirements for chargers

1.1.e Does your company sell passenger EVs?

- Summary: Tax incentives for passenger EVs. The IRA extends and modifies the tax incentive for passenger EVs offering income-eligible consumers who purchase an electric vehicle that meets domestic battery and/or mineral sourcing requirements a tax incentive of up to $7,500. Additionally, income-eligible customers who purchase a used EV may be eligible for a tax incentive of up to 30% of the vehicle price (max $4,000).

- Timeline: Available now for vehicles purchased after December 31, 2022 and before December 31, 2032. Beginning in January 2024, dealers can offer the credits at the point of sale.

- Best for: Retailers who sell electric vehicles or electric vehicle equipment. While the consumers will need to apply for the tax incentive themselves, retailers can help market their products by increasing consumer awareness of the tax incentives.

- Learn more: IRS Manufacturer and Seller Guidance | SAFE and the Electrification Coalition | Plug in America

Does your company use US Postal Service for last mile delivery?

The IRA includes $3 billion for the US Postal Service to upgrade and decarbonize its fleet by purchasing zero-emission delivery vans and installing infrastructure needed to support the vans. Resulting emission reductions can help support your Scope 3 goals.

1.2. Building Efficiency

1.2.a Does your company own commercial real estate?

- Summary: Expanded tax incentives to improve energy efficiency. Under the IRA, commercial building owners can apply for a $5-per-square-foot tax incentive to support energy efficiency upgrades that help lower utility bills, for buildings placed into service after January 1, 2023. This represents a three-fold increase in the existing incentive of $1.88 per square foot. Building improvements that reduce the energy and power costs of interior lighting, HVAC, and hot water systems by at least 50% qualify for the full $5 incentive , though the program has tiered requirements. A 25% reduction qualifies for a $2.50 deduction, with the incentive increasing on a sliding scale up to the maximum $5.

- Timeline: Available now.

- Best for: Any retailer who owns commercial real estate.

- Learn more: DOE Office of Energy Effficiency & Renewable Energy | Updated IRS Reference Standard for Section 179D

1.2.b Does your company own commercial real estate with a transformer?

- Summary: Financing to modernize commercial properties. DOE is offering rebates for up to $25,000 to purchase an energy efficient transformer to replace an energy inefficient transformer. Eligible entities include owners of commercial buildings and owners of industrial or manufacturing facilities.

- Timeline: Applications closed on December 15, 2023.

- Best for: Retailers who owns commercial real estate or manufacturing facilities.

- Learn More: DOE Guidance | DOE finalized standards on energy efficiency standards for transformers

1.2.c Does your company use extended product systems?

- Summary: Rebates for extended product systems. DOE is offering rebates for an aggregate of up to $25,000 to purchase a qualified extended product system that is installed on or after October 1, 2021.

- Timeline: Applications closed on December 15, 2023.

- Best for: Retailers who owns commercial real estate or manufacturing facilities.

- Learn More: DOE Guidance

1.2.d Does your company sell energy efficient products?

- Summary: Tax incentives for residential energy efficient upgrades. The IRA extends and modifies the tax incentives for certain energy efficient improvements including Heat Pump Water Heaters, Heat Pumps, Biomass Stove/Boilers, Insulation, Windows/Skylights, Exterior Doors, Central Air Conditioners, Natural Gas, Oil, Propane Water Heaters, Furnaces and Boilers, Natural Gas, Oil, Propane Furnaces/Boilers, Electric Panel Upgrades, and Home Energy Audits. While the tax credit is limited to 30% of the project cost, the cap has been increased from a lifetime cap of $500 to an annual cap of $1,200 to $2,000.

- Timeline: January 1, 2023-December 31, 2032.

- Best for: Retailers who sell ENERGY STAR equipment. While the consumers will need to apply for the tax incentive themselves, retailers can help market their products by increasing consumer awareness of the tax incentives.

- Learn more: View information from ENERGY STAR here and here, plus an FAQ from DOE. More information coming soon from the EPA. RILA will keep its members up-to-date on any requirements associated with the tax rebates.

1.3. Clean Energy

1.3.a Is your company interested in procuring renewable energy?

- Summary: Tax incentives for renewable energy. The IRA extends through 2024 investment and production tax incentives (ITC and PTC, respectively) for renewable energy projects. Projects eligible for the ITC include solar, wind, energy storage, combined heat & power, and microgrid controllers, among others. Projects eligible for the PTC include solar, wind, biomass, landfill gas, and hydroelectric, among others. Beginning in 2025, a new technology neutral credit will replace the existing ITC. It will apply to generation facilities and energy storage systems that have an anticipated greenhouse gas (GHG) emissions rate of zero. The incentive will be phased out as the U.S. achieves its GHG reduction goals.

- Timeline: Existing tax incentives in place through 2024. Updated tech neutral credit takes effect for projects placed into service on January 1, 2025 or later.

- Best for: Retailers that operate their renewable generation systems or energy storage projects and retailers that operate in states where they can enter into PPAs as energy off-takers or work with utilities to procure renewable energy. Investment and production tax incentives for renewables help lower development costs, which in turn can reduce the cost of power.

- Learn more: Information from the EPA and the Database of State Incentives for Renewables & Efficiency | Prevailing Wage & Apprenticeship Requirements

1.3.b Does your company have U.S. manufacturing/production operations with significant greenhouse gas emissions?

- Summary: Tax incentives for advanced energy projects. The IRA provides $10 billion worth tax credits, up to 30%, for investment in projects that (1) re-equip, expand, or establish an industrial manufacturing facility that produces or recycles certain clean energy equipment or vehicles; (2) re-equip an industrial or manufacturing facility to reduce GHG emissions by at least 20%; or (3) re-equip, expand, or establish an industrial facility to process, refine, or recycle critical minerals.

- Timeline: Applications are open until October 18 for $6 billion in tax credit allocations.

- Best for: Retailers that have large manufacturing facilities and/or produce clean vehicles.

- Learn more: IRS Credit 48C Guidance | DOE FAQ | Application templates are available in the article titled "2024 Fully Application Forms Template in the 48C portal

1.3.c Is your company interested in using carbon sequestration at U.S. manufacturing facilities?

- Summary: Tax incentives for carbon capture. The IRA extends tax incentives to incentivize deployment of carbon capture, utilization, and storage. For projects placed into service on or after February 9, 2018, the credits accrue to the person/entity who owns the capture equipment and provides for the disposal or utilization of the carbon. The IRA increases the size of the available credit to $85 per ton, or $180 for direct air capture, and reduces the size of facility eligible to qualify.

- Timeline: Available now.

- Best for: Retailers with large manufacturing facilities.

- Learn more: IRS Guidance | Request for Comment from 2022 | Fact sheet from Clean Air Task Force

1.3.d Is your company interested in pursuing clean hydrogen for U.S. facilities or hydrogen fuel cells for vehicles?

- Summary: The IRA provides a tax incentive of up to 30% for use of clean hydrogen.

- Timeline: DOE iisued proposed guidance on the hydrogen tax credits in December 2023 with final regulations still to come.

- Best for: Retailers that have large manufacturing facilities and retailers that own their fleets or contract with a third-party shipper.

- Learn more:Public comment on the proposed guidelines was due on February 26,2024. | Also see DOE's production standard for clean hydrogen.

PART 2: DIRECT OPPORTUNITIES ADMINISTERED BY STATE AND LOCAL GOVERNMENTS

The Infrastructure Law includes several programs that authorize federal agencies to provide states and local governments with funds to establish grant, loan, and training programs aimed at modernizing and decarbonizing energy, building, and transportation sectors. Retailers may be eligible for these programs, but because they will be administered by individual energy and transportation offices, application deadlines and guidelines may vary by state.

2.1. Building Efficiency

2.1.a Does your company own or lease large commercial real estate?

- Summary: Funding to modernize commercial properties. The U.S. Department of Energy will allocate $250 million to states so they can, in turn, establish revolving loan funds and grants for commercial [and residential] building owners to complete energy audits, upgrades, and retrofits that will increase the efficiency, physical comfort, and air quality of existing building infrastructure. To be eligible for funding, companies must conduct the majority of their business in the state providing the loan.

- Qualifying energy audits will determine the building’s overall energy consumption, peak energy demand period, and primary sources contributing to that demand, as well as identify and recommend solutions.

- Qualifying retrofits will improve either the building’s physical comfort, energy efficiency, or air quality AND either reduce the building’s overall energy intensity or improve its energy control and management.

- Timeline: The federal government has awarded $66 billion to 17 states and territories. Property owners can learn more about the application process from individual state/territory offices (see DOE's map of award recipients).

- The federal government expects to make grant awards to states and territories in spring 2024, after which point we expect the states to release more information about how individual property owners can apply. •

- Best for: Big box stores and other retailers that own commercial real estate. Companies that lease their buildings may also want to speak with their landlords about this program.

- Learn more: Energy Efficiency Revolving Loan Fund Capitalization Grant Program | FAQ from DOE

2.2 Transportation — EV Infrastructure

US DOE and the US Department of Transportation's Federal Highway Administration (FHWA) are jointly administering two Infrastructure Act programs that support the build out of electric vehicle (EV) infrastructure: the National Electric Vehicle Infrastructure (NEVI) Formula Program and the Discretionary Grant Programs for Charging and Fueling Infrastructure. The Joint Transportation Office will be granting funds from each of these programs to states or other planning or governmental entities who will manage the implementation and distribution processes. Each of these programs has the potential to offset a significant portion of EV infrastructure costs, especially as they may be stacked with other federal and state incentives and grants. However, funding is time limited so now is the time to get engaged in the planning and application processes. Information on state programs can be found on state highway administration/department of transportation websites; additionally, RILA can help you connect to the right State Retail Associations who can help advocate on your behalf.

2.2.a Does your company have retail locations with existing fuel operations or amenities that are located along a major highway?

- Summary: National Electric Vehicle Infrastructure (NEVI) Formula Program. The Joint Transportation Office is administering $5 billion over five years of dedicated funding that will be provided to States to strategically deploy EV charging infrastructure and establish an interconnected network to facilitate data collection, access, and reliability.The NEVI plans are based on an 80/20 formula where 80% of the charging infrastructure and installation costs will be covered by the federal government, and the state is responsible for 20% of the costs.

- So far, states have submitted two years' worth of NEVI plants to the federal government for approval. While the overall structure of the initial plans are the same, specific details vary. Key takeaways from the initial plans include:

- All states allow for private entity investment and plan to run competitive solicitations.

- The 20% state match will be the responsibility of the private entity that will own the chargers.

- In the first year, some states are looking to partner with private entities that offer amenities close to the highways while others are limiting first round of investment only to highway locations.

- Timeline: Initial funding under this program is desgined to build out Alternative Fuel Corridors, particularly along the Interstate Highway System. When the national network is fully built out, funding may be used on any public road or in other publicly accessible locations. The Joint Office released a Year 1 report on July 11, 2023.

- Best for: Between 2022-2026, convenience stores with existing fuel operations and retailers with amenities located close to highways. Between 2023-2026, retailers that are either interested in installing, or partnering to install, EV chargers or that are interested in ensuring chargers are installed in locations that can benefit their operations.

2.2.b Does your company have retail locations along a state designated alternative fuel corridor?

- Summary: Funding for charging and fueling infrastructure in designated corridors. The Joint Transportation Office has $1.25 billion in discretionary funding to allocate to projects that strategically deploy publicly accessible EV charging and other alternate fuel infrastructure (such as hydrogen, propane, and natural gas) along a designated alternative fuel corridor. Eligible applicants include states, territories, tribes, metro planning organizations, local governments, and public authorities with a transportation function — but these entities must contract with a private entity for the acquisition and installation of publicly accessible EV or alternate fuel infrastructure.

- Timeline: The latest Notice of Funding Opportunity closed on September 11, 2024.

- Best for: Big box stores and other retailers that own commercial real estate. Companies that lease their buildings may also want to speak with their landlords about this program.

- Learn more: Most recent Notice of Funding Opportunity | List of funding recipients from FY22 and FY23 | Register for webinars on June 6 and June 11 | Catch up on past informational webinars.

2.2.c Does your company have existing fuel or retail operations in rural areas, low- and moderate-income neighborhoods, or communities with a low ratio of private parking spaces?

- Summary: Funding for community charging and fueling infrastructure. The Joint Transportation Office will allocate $1.25 billion to projects that expand access to EV charging and alternate fueling infrastructure in rural areas, low- and moderate-income neighborhoods, and communities with a low ratio of private parking spaces. These projects, which aim to fill in gaps in EV infrastructure, can be located at publicly accessible parking facility owned by a private entity.

- Timeline: Applications closed on September 11, 2024.

- Best for: Big box stores, retailers that own commercial real estate, companies that serve rural or low/moderate-income communities. Companies that lease their buildings may also want to speak with their landlords about this program.

- Learn more: Most recent Notice of Funding Opportunity | List of funding recipients from FY22 and FY23 | Register for webinars on June 6 and June 11 | Catch up on past webinar presentation and watch recording.

2.3 Emissions Reduction and Clean Energy Projects

2.3a Is your company interested in procuring renewable energy, particularly in rural areas?

-

Summary: Loans for renewable energy projects in rural areas. Under the IRA, the Powering Affordable Clean Energy (PACE) program will forgive up to 40% of loans (60% if serving tribes or territories) for renewable energy projects — including wind, solar, storage, hydropower, geothermal, and biomass. At least half of the population served by a project must live in communities with 20,000 people or fewer. Energy projects that receive PACE funding must be sold for resale to eligible utility and non-utility offtakers.

Eligible Applicants: Corporations, states, territories and tribes, utility districts, and non-profits, among others are eligible to seek funding. Retailers could seek to become offtakers from funded projects.

Timeline: Letters of intent were due on September 29, 2023.

Learn More: USDA Program Overview | View award recipients

2.3b Does your company serve low-income communities?

- Summary: Funding to reduce greenhouse gas emissions. The IRA allocated $27 billion to the Environmental Protection Agency to fund projects that reduce greenhouse gas emissions, particularly in low-income and disadvantaged communities, through the leveraging of private sector funds and deployment of zero- or low-emissions technology. The Greenhouse Gas Reduction Fund includes: (1) $7 billion dollars for competitive grants to enable low-income and disadvantaged communities to deploy or benefit from zero-emission technologies, including distributed technologies on residential rooftops, and to carry out other greenhouse gas emission reduction activities; (2) nearly $12 billion dollars for competitive grants to nonprofit non- depository finance entities to support direct and indirect financial and technical assistance to projects that reduce or avoid greenhouse gas emissions; and (3) $8 billion for competitive grants to eligible entities for the provision of financial and technical assistance to projects that reduce or avoid greenhouse gas emissions in low-income and disadvantaged communities.

- Eligible Applicants: States, municipalities, Tribal governments, and non-profit organizations, subject to certain requirements.

- Timeline: Grants may be awarded through September 30, 2024.

- Best for: Retailers that sell zero- or low-emissions technology or that serve low-income or disadvantaged communities.

- Learn more: EPA has issued notices of funding opportunities for several programs within the fund: the National Clean Investment Fund, the Clean Communities Investment Accelerator, and Solar for All. | View additional EPA documents

PART 3: OPPORTUNITIES TO INFORM THE MODERNIZATION OF TRANSPORTATION NETWORKS

The Infrastructure Law includes significant money to improve highways and ports, with a central goal of reducing greenhouse gas emissions associated with the transportation sector and ensuring safe and efficient freight movement throughout the U.S. Though retailers would not apply directly for this funding, you may want to engage with state and local governments, state and regional planning organizations, and freight partners about projects where your major operations are located or along your transportation networks to ensure the investments support your transportation needs. These funding opportunities can help assist with reducing your Scope 1 (associated with your own fleet) or Scope 3 (associated with contractor fleet) emissions. Note: many of these programs specifically ask applicants to describe how their project will impact climate change and environmental justice communities.

Please contact RILA if you are interested in any of these programs as we are exploring whether we should increase engagement on these issues to support our members.

3.1 Freight Transportation

3.1.a Does your company use freight transportation to move its goods over highways?

- Summary: Financing to improve highway freight movement. The U.S. Department of Transportation will grant approximately $1.4 billion per year in additional funding to states for projects that improve freight movement within the National Highway Freight Network, with a goal of reducing congestion, improving safety, and lowering the cost of freight transportation. Some funds may also go towards rail or intermodal freight projects.

- Eligible Recipients: Funding is appropriated to the states.

- Timeline: Applications are closed for this year.

- Best for: Retailers that move or ship goods long distances either with their own fleet or through a third-party contractor.

- Learn more: National Highway Freight Program

3.1.b Does your company transport goods through rural areas?

- Summary: Financing for surface transportation projects in rural areas. DOT will grant $2 billion for projects, including highway, bridge, and tunnel projects that increase connectivity and improve the movement of freight.

- Eligible Recipients: Individual states, regional transportation planning organizations, local government, tribes, or a multijurisdictional group of these entities.

- Timeline: DOE solicits applications annually.

- Best for: Retailers that move or ship goods through rural areas either with their own fleet or through a third-party contractor.

- Learn more: Information from DOE: Multimodal Project Discretionary Grants — Rural Surface Transportation Grants | View past grant recipients

3.1.c. Does your company rely on surface transportation networks to move its goods?

- Summary: Financing to support complex infrastructure projects. DOT will grant $5 billion for large, complex projects that are likely to generate economic, mobility, or safety benefits but are difficult to fund by other means. This includes highway, bridge, and freight rail projects. DOT will also be awarding $8 billion to projects to significant multimodal freight and highway projects that will generate economic benefits, reduce congestion, enhance resilience, and eliminate freight bottlenecks. This includes highway, highway freight, and bridge projects; certain intermodal freight, freight rail, and port infrastructure projects; and certain marine highway corridor projects and surface transportation projects connected to an international border.

- Eligible Recipients: Eligible applicants include states, groups of states, tribes, local governments, metro planning organizations, transportation authorities, port authorities, a multi-state/jurisdictional group of these entities, and others.

- Timeline: Applications are closed for this year.

- Learn more: Information from DOE: Multimodal Project Discretionary Grants — Mega Grants; Multimodal Project Discretionary Grants — INFRA Grants | View past award recipients

Infrastructure Funds at Work

The Biden administration recently announced the first 26 projects to receive funding through the INFRA Grant program. Several of these projects will have major benefits for shipping efficiency, including- DOT is investing in a project in West Central Florida to build a new commercial truck parking facility with 120 spaces, electric chargers, and at least six electrical hookups to provide stand-by power for refrigerated trucks and auxiliary power for in-cab comforts. The goal of this project is to address a shortage of commercial truck parking on I-4 between Tampa and Orlando, a corridor that more than 18,000 trucks travel daily, according to DOT. The parking facility will also be connected to the Florida DOT’s “Truck Parking Availability System,” so drivers can check when parking spaces are available.

- DOT allocated funding to a San Diego project that will improve supply chains by constructing a new road and a new port of entry facility in Otay Mesa. The existing Otay Mesa and Tecate ports of entry are at capacity. This project will establish an alternate route for nearly 3,600 trucks that cross daily into these ports.

3.2 Ports

3.2.a. Does your company rely on ports to import goods?

- Summary: Funding to reduce truck emissions at ports. The IIJA allocated DOT $80 million in annual funding to (a) study how emissions reduction strategies, like electrification or use of other emerging technologies, could be deployed at U.S. ports and (b) provide grants to test or deploy projects that will reduce emissions from truck idling at ports through electrification or other improvements to energy efficiency.

- Learn more: Reduction of Truck Emissions at Port Facilities

- Summary: Funding to improve port infrastructure and reduce emissions. The Maritime Administration (MARAD) will grant $2.25 billion in IIJA funding to projects that improve the safety, efficiency, and reliability of port facilities, including through projects that reduce or eliminate toxic air pollutants and greenhouse gas emissions.

- Eligible Applicants: States or political subdivisions, local governments, tribes, public agencies/authorities, including port authorities, special purpose district with a transportation function, and multistate or multijurisdictional entities. These parties may apply jointly with a private entity, including port owners and operators.

- Timeline: Applications are closed for this year.

- Best for: Retailers that rely on ports to import or export goods.

- Learn more: Port Infrastructure Development Program | Notice of Funding Opportunity | View past year's awardees

- Summary: Funding to reduce air pollution at ports. The U.S. Environmental Protection Agency (EPA) will award $3 billion in IRA funding to projects that reduce pollution from ports, including through the purchase and installation of zero-emission port equipment and technology; support for the development of climate action plans, and support to develop accounting and inventory practices that will reduce greenhouse gas emissions and other air pollutants.

- Eligible Applicants: Port authorities, state, regional, local, or tribal agencies with jurisdiction over a port authority or port, air pollution control agencies, or private entities that own or operate port facilities/equipment and apply with another eligible applicant.

- Timeline: Applications for the Clean Ports Program: Zero-Emissions Technology Deployment Competition closed on May 28, 2024.

- Best for: Retailers that rely on ports to import or export goods.

- Learn more: Most recent Notice of Funding Opportunity | View the recording and slides from an EPA informational webinar on October 31, 2023.

Example State GHG Target and NEVI Program Highlights

View a few select state plans below. Please contact Erin Hiatt if you would like assistance in reviewing a particular state plan.

Louisiana

Louisiana

State GHG Target: Reduce net GHG emissions 26–28% by 2025 and 40-50% by 2030, compared to 2005 levels, and achieve net-zero GHG emissions by 2050 (Executive Target)

Total NEVI funding: $ 73,367,735

- Location of existing amenities such as supermarket, convenience store is weighted most heavily in scoring suitability (25% of score)

- Amenity count is additionally weighted at 6.3% of the score

Additionally, DOTD is encouraging charging sites to include pull through spots as that may contribute to supporting freight transportation by electric vehicles.

Maryland

Maryland

State GHG Target: Reduce GHG emissions 40% below 2006 levels by 2030 (statute)

Total NEVI funding: $ 62,818,576

MDOT/MEA has announced condition awards from its first-round solicitation. The funds went to private entities building projects along Alternative Fuel Corridors. MDOT plans to look at off-corridor, community-based investments in the future years of the program. The state also issued an EV Infrastructure Planning Survey, which received more than 1,400 responses.

Additional Notes of Interest: Maryland is actively participating in the Multi-State ZEV Task Force to develop the MHD ZEV Action Plan that will provide a framework for meeting the target of at least 30 percent of all new truck and bus sales being ZEVs by 2030 and 100 percent by 2050. MDOT is also currently updating the Maryland State Freight Plan, which identified the need for EV infrastructure and the use of alternative energy sources for freight transportation vehicles, multimodal support equipment, or related applications as a strategy for consideration.

Maryland also administers a number of state grant and rebate programs to support vehicle decarbonization, including:

- Electric Vehicle (EV) Workplace Charging Grant: The Maryland Department of Environment (MDE) offers grants for up to $4,500 per Level 2 EV charger and $600,000 per applicant for the installation of EV charging stations at workplaces through the Charge Ahead Grant Program (CAGP).

- Electric Vehicle Supply Equipment (EVSE) Rebate Program: Businesses registered and in good standing with the Maryland State Department of Assessments and Taxation (SDAT) can get up to $4000 to purchase and provide EVSE that are either located at a workplace for their employees or that are used to support fleet electric vehicles.

- Clean Fuels Incentive Program: Fleet vehicle operators, commercial entities, corporations, and others are eligible for grants to retrofit fleets or purchase new Alternative Fuel Vehicles. The program has a budget of up to $1,300,000.

Missouri

Missouri

State GHG Target: None

Total NEVI funding: $ 98,961,186

Missouri will focus initially on establishing the program, assessing best practices and preparing for deployment. Priority locations may change, depending on private investments that occur along interstate highways. The state has not yet identified exact locations of charging stations (e.g., specific businesses or parking lots). Applicants for funding will be required to identify the specific location in each community where they propose to install charging equipment. Potential planned sites include: locations where a town with gas stations is near the highway and which reduce the distance between chargers to less than 50 miles; in evaluating locations, more points would be awarded for sites that have facilities to accommodate drivers while they wait, such as restrooms, dining, and entertainment.

Additional Notes of Interest: Missouri recently competed an update of its state freight and rail plan. Missouri anticipates that its freight energy demands are larger than available DCFC networks planned for passenger vehicles. Accordingly, it plans to address freight in more detail in future NEVI plans. It also plans to account for the needs of the smallest / most vulnerable freight haulers in its NEVI deployments as the freight vehicles moving through the state include nationwide companies and independent owner-operators.

Missouri also offers EV Charging Station Grants to government and non-government entities of up to 80% of the cost to purchase, install, and maintain Level 2 and direct current fast charging (DCFC) stations at eligible locations.

Oregon

Oregon

State GHG Target: Reduce emissions 10% below 1990 levels by 2020 and 75% below 1990 levels by 2050 (statute); Reduce GHG emissions 45% below 1990 levels by 2035 and 80% below 1990 levels by 2050 (Executive Target)Total NEVI funding: $ 52,249,356

ODOT made an initial award to Electrify America for NEVI station work along Interstate 205. The department plans to make additional awards in late October or early November for NEVI stations along US 97 and Interstate 5 south of Eugene.

Earlier this year, ODOT decided to transition away from a "design-build-operate-maintain" contract for its NEVI program and to instead employ a competitive grant program for each road. The department said this approach will allow them to roll out the funds "faster and mroe cost effectively."

When awarding NEVI funds, Oregon will give preference to applications that provide executed site host agreements or letters from site hosts which show the space is available for the full five-year duration of the NEVI agreement.

Selection criteria for sites include: close proximity to numerous amenities, where possible, such as modern, sanitary bathroom facilities, access to drinking water, shelter, lighting, snack food, dining, shopping, and/or entertainment and recreation options.

ODOT hosted two virtual listening sessions to discuss their NEVI work. The department also published an "online open house" to educate the public about the NEVI program and held community meetings along first year corridors.

Additional Notes of Interest: The State NEVI planning website has surveys for businesses that already host EV charging stations and ones that do not currently host but are interested in hosting in the future.

Texas

Texas

State GHG Target: None

Total NEVI funding: $ 407,774,759

TXDOT has issued Round 1 NEVI funding which includes support for at least 66 fast charging ports. The state has now reopoened its application for 35 study areas along its Phase 1 Alternative Fuel Corridor; those applications are due October 28.

Texas awards contracts on a competitive basis to private entities to install, operate, and maintain EV charging infrastructure along Electric Alternative Fuel Corridors. The private entity will pay the state’s 20% share of the cost. No state funds will be used and TxDOT will not own or operate any charging equipment. Year One will focus on building out the Electric Alternative Fuel Corridors to meet FHWA guidance (approximately 55 new locations), and Years Two and Three (or after Fuel Corridors are completed) will focus on building out networks in rural counties, small urban areas, and Metropolitan Planning Organizations. TxDOT plans to Work with Metropolitan Planning Organizations to identify suitable locations to install a combination of Level II and DC Fast Charging infrastructure inside large urban areas.

Additional Notes of Interest: Texas manages an Emissions Reduction Plan (TERP) Rebates Program that provides grants to individuals, state and local governments, corporations, or any other legal entity to upgrade or replace diesel heavy-duty vehicles and/or equipment.

Latest Sustainability / Environment Insights

RILA Promotes Erin Hiatt to Senior VP, Retail Operations

- By [Melissa Murdock]

- 05/20/2025

RILA’s Kathleen McGuigan Will Turn the Page at End of 2025

- 05/01/2025

Retail Litigation Center Announce Leadership Transition Plan

- 01/29/2025

RILA BOD Adds Four Leaders, Re-Elects Best Buy CEO as Chair

- By [Brian Dodge]

- 01/27/2025

How to access the benefits of the Inflation Reduction Act

- By [Hans Royal]

- 08/01/2024

Downstream Scope 3 Emissions Reporting Resource Available

- By [Erin Hiatt]

- 05/21/2024