One Year Later: 40 States See Sales Tax Fairness

- 06/21/2019

"Today's ruling will give every retailer the opportunity to compete on a level playing field without government's thumb on the scale—that's a win for all those who believe in free markets," said Deborah White, General Counsel for the Retail Industry Leaders Association and President of the Retail Litigation Center.

"States had this authority taken from them decades ago," said White. "Most will work quickly and judiciously to reclaim their authority and create a level playing field for all retailers selling to customers in their states."

Many states already had some form of economic nexus legislation on the books but lacked the authority to enforce it. Shortly after the decision gave them that authority, many of these states adopted regulations and put out notice of enforcement, all of which was prospective.

To assist those states that had no statute on the books, RILA worked with the states and other stakeholders to develop a sound legislative model to help states enforce the WayFair decision. That model provided a roadmap to help lawmakers address both economic nexus and marketplace collection, aligning closely with South Dakota’s law and the Court’s guidance in its decision. States without statutes on the books quickly took action as legislative sessions began in January 2019.

The result?

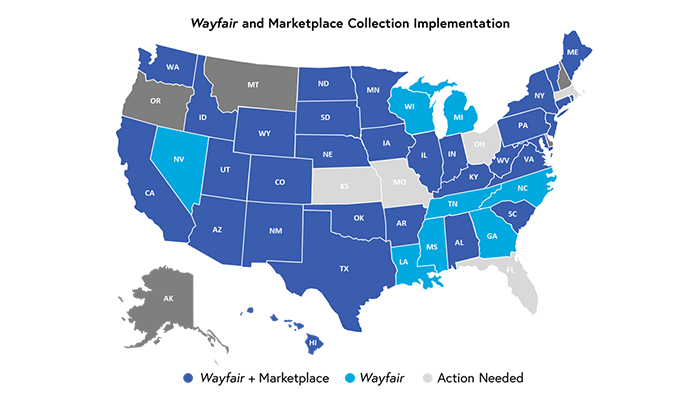

40 states and the District of Columbia require the collection and remittance of sales tax on purchases made online. Of those 41 – 33 also require it on purchases made through a third-party marketplace. States are seeing higher than expected revenue and retailers are now able to compete on a level playing field; all without raising taxes.

“As predicted, after decades of fighting for sales tax fairness, states worked quickly and judiciously to create sales tax parity once given the authority,” said Brian Rose, RILA director of state affairs & advocacy. “It’s been an exciting 12 months watching states take action across the country, only a handful more need to take action to have a truly level playing field nationwide.”